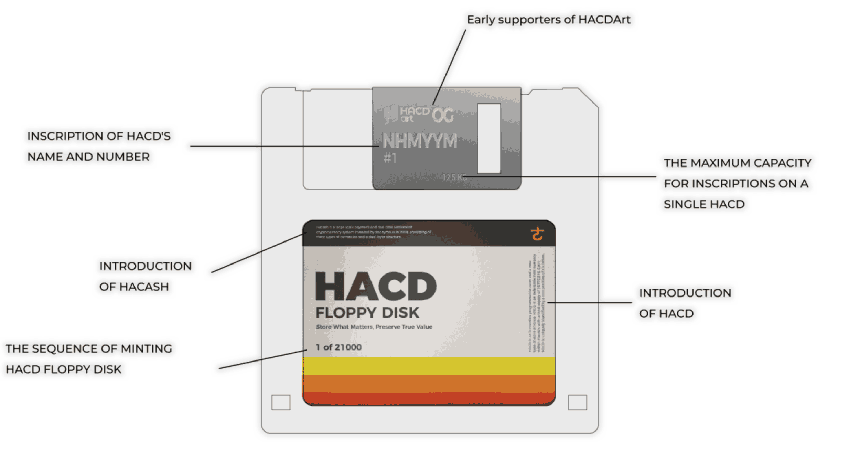

HACD Floppy Disk symbolizes recognition for early supporters to HACDArt and serves as a historical witness to the journey of HACD programming. Just like the old floppy disk, HACD has limited storage capacity, yet it highlights the value. In today's era of a glut of cryptocurrency, we don't need a vast array of tokens; instead, we seek curated value. HACD, along with its assets, is one of the few we truly need, storing what matters and preserving true value.

HACD(Hacash Diamond) Resource Center

Your Comprehensive Guide to Everything HACD